Executive Summary

The trade battles with China hit US goods exporters in 2018. Services exports increased, but at a slower pace than in previous years. Despite these challenges, China continued to be important to US economic growth, supporting more than 1.1 million jobs.

- China is the third-largest market for US goods and services exports. Despite trade friction and punitive tariffs, China remained a top market for US goods exports in 2018, with only NAFTA partners Canada and Mexico buying more goods last year. It was also the third-largest market for US services exports, after the United Kingdom and Canada.

- The world is waiting to see whether a trade agreement between the United States and China will address tariffs and other trade issues. A rollback of at least some of the tariffs imposed by both governments is expected, though it is not yet clear how many products will receive relief. In addition, China may reportedly commit to purchase additional US goods worth more than $1 trillion over the next six years. These factors may increase the volume of US goods exports to China in 2019.

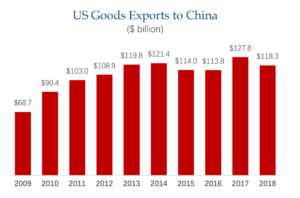

Goods Exports

- US goods exports to China declined in 2018, after breaking a record the previous year. In 2018, the United States exported $118.9 billion in goods to China, compared with an all-time high $127.9 billion in 2017. The seven percent, or $9 billion, decline is likely due to the trade conflict between the United States and China which resulted in retaliatory tariffs on an estimated 85 percent of US goods, including most agricultural products.

- Despite the decline, goods exports to China still outpaced export growth to the rest of the world over the last decade. US exports of goods to China increased 73 percent over the last decade, while exports to the rest of the world grew only 57 percent.

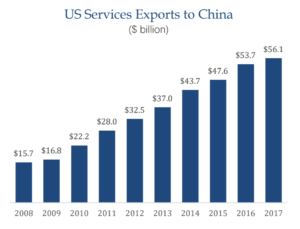

Services Exports

- Compared to previous years, US services exports to China grew more slowly in 2017, the latest year of full data, though they still outpaced services exports to other major markets. Services export growth to the rest of the world grew 2.7 percent faster than China that year. Over the last decade, however, US services exports to China grew significantly more rapidly than to the rest of the world – 258 percent versus 49 percent.

US Exports and US Jobs

- Exports to China support over 1.1 million American jobs. States across the country have jobs that are supported thanks to US exports to China, making trade important to not only US companies and consumers, but also US workers. US goods exports to China come from a wide range of industries including transportation equipment, semiconductors and oil and gas, sustaining logistics jobs in America’s ports and throughout the country. US services exports to China included travel and education, industrial processes, and management services, among other industries.

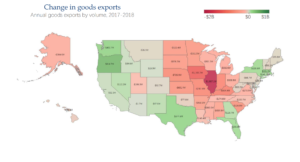

States across the country feel the effects of the trade dispute

- Most states have seen significant increases in exports of goods and services to China in the past decade, though exports in the last year were down—in some cases, significantly. Forty-eight states have increased their goods exports to China during the last decade, and all 50 states increased their services exports by triple digits.

- Growth in exports to China slowed due to trade disputes between the United States and China. Thirty-four states exported fewer goods to China in 2018 than they did in 2017, and another four states had only single-digit growth. Midwestern and Plains states that export significant quantities of soybeans and other agricultural products were hit particularly hard. In services, nine states exported less to China in 2017 than they did in 2016, and only one state—Delaware—had double-digit growth in services exports.

- Trade disputes also affected the overall value of exports to China. In 2017, 30 states exported more than $1 billion in goods to China; in 2018, only 26 states exported more than $1 billion in goods to China. For services, 15 states exported more than $1 billion to China in 2016 and 17 states exported more than $1 billion to China in 2017. Continued growth in services may be the result of services exports not being subject to tariffs.

- China is among the top five goods and services export markets for most states. China was the top goods export market for four states in 2018, and among the top five markets for 44 states. In services exports, China was the top market for 15 states in 2017, and a top five market for 49 states.

To read original report, click here