Perhaps surprisingly, little is known about the capacities of different countries to produce vaccines. Official data on global production volumes is not available and trade data only gives an incomplete picture of production capacity. The United States and China, for instance, import and export low levels of vaccines relative to their population sizes, suggesting that major parts of vaccine production are not reflected in trade data.

To understand how COVID-19 has affected global trade in, and production of, vaccines, and to get a sense of where the main capacities to produce COVID-19 vaccines at scale might be found, we looked at global vaccine trade prior to the pandemic and estimated production worldwide, with two main results. First, pre-pandemic, the EU was the world’s largest producer of vaccines. Second, the pre-pandemic market for vaccine was divided into two spheres: rich countries are supplied by EU and US production capacity (with the latter mostly producing for itself), while India was the main producer for developing countries. China produced almost exclusively for its own market.

Evidence since the start of the pandemic indicates that, while broadly COVID-19 has not changed these production patterns, there have been modifications. China has become a major supplier of COVID-19 vaccines to developing countries, using its vaccines as political leverage and benefitting from the fact that the US has yet to export its production, while India has stated explicitly that it will prioritise its own population. In this context, with its substantial production capacity, the EU will play a major role as a global COVID-19 vaccine supplier as the world continues to tackle the pandemic.

The global vaccine trade pre-pandemic

Figure 1 shows the biggest vaccine exporters pre-pandemic (2017-2019). The EU27 as a bloc (ignoring intra-EU trade) was by far the largest exporter of vaccines to the world, both in terms of volumes (44% of total global exports) and value (60.3%). The larger share of value compared to volume indicates that the EU exported relatively more to markets where it could supply at higher prices, ie high-income countries (HICs). Figure 2 shows this: while the EU supplied 60% of the vaccines imported by HICs, it only supplied 12% of the vaccines imported by low-income countries (LICs). The US and the United Kingdom were the major revenue markets for the EU’s vaccines exports, representing 43.4% and 16.7% respectively of total EU revenues from export of vaccines. Taken together, LICs provided only 1.2% of EU revenues from vaccine exports (7.4% from lower-middle income countries, so 8.6% for LICs and lower-middle income countries), but absorbed 3.9% of volumes exported from the EU (33.2% for lower-middle income countries).

With a share of 22%, the US was the second largest exporter in value terms (though only one third of the EU size). But like the EU, the US pre-pandemic mostly exported to other HICs: it represented only 2% of volumes imported by LICs (Figure 2). For India, the opposite was the case. While India was the second-largest vaccine exporter in terms of volumes (24.7% of total global exports) it represented barely more than 2% of vaccines exports in terms of value. This huge discrepancy is linked to the fact that India exported virtually only to LICs, representing 80% of their vaccine imports by volume (Figure 2).

These trade patterns reflect a highly segmented market for vaccines, with HICs representing the bulk of revenues, while LICs represent the bulk of volumes. High-income producers (EU, US) sell vaccines to high-income countries, while India provides vaccines to low-income countries. This notable market segmentation is associated with the licensing practices of the pharmaceutical industry.

The largest life sciences companies by vaccine revenues are: GSK, Merck, Sanofi and Pfizer, which represent about 90% of global vaccine revenues. They license their patents to producers in LICs to produce and sell to LICs, reserving HIC markets for their own production or dedicated HIC licensees. In particular, the Serum Institute of India plays an outsized role as a licensee, supplying vaccines to low-income countries.

Estimating vaccine production capacities

To get a full picture of global vaccines supply patterns before the pandemic, we looked not only at the trade flows, but also at production capacities. In the absence of official data on global vaccine production, we estimated countries’ production volumes from the available trade data. For this, we first estimated internal demand. We looked at countries that are not producers (ie countries that export virtually no vaccines). For these countries, we assumed that their total demand for vaccines is equal to their imports. This gives a sense of what the ‘consumption’-based demand for vaccines is. Based on this approach, we provide a range of estimates. We computed the average imports per capita of non-producing countries and used this to compute demand for all countries. We also looked at the relationship between imports per capita and a ‘vaccine index’ based on the demographics and immunisation rates in the same non-producing countries. We computed estimates both with and without income-level segmentation by country. We then derived production estimates per country as the sum of our estimates of their demand and their net exports.

All estimates produce similar results and give a good sense of the scale of production volumes across the world. Table 1 sets out our estimated production volumes per country. Taken as a whole, the EU is the world’s largest producer of vaccines, closely followed by India, with estimates of around 15.5 million and 14.5 million kilogrammes of vaccines produced yearly, respectively. China with production in the realm of 8 million to 12 million kilogrammes comes in third place. The United States is in fourth place, but with considerably smaller production volumes of 4.5-5.2 million kilogrammes. Other countries with considerable vaccine production capacity are Indonesia, Japan, South Korea and Russia. No African or Latin American country has an estimated production capacity of more than 1 million kilogrammes.

Among vaccine producers, the EU pre-pandemic exported the greatest (estimated) volumes of the vaccines it produced, apart from South Korea, which also has a high export-intensity, but from only a small (estimated) production capacity. China, meanwhile, exported almost no vaccines before COVID-19.

Table 1: Range of estimates of yearly vaccine production (millions of kg, 2017-2019 data)

COVID-19 and the future of vaccine production

While it is tempting to draw conclusions from these numbers about the capacity to produce COVID-19 vaccines, there are couple of caveats. First, our data reflects production capacity in ‘normal’ times (2017 to 2019 averages) and for a broad spectrum of vaccines. It is unclear to what extent new capacity has been installed or how much this capacity has been adapted to produce COVID-19 vaccines at the required scale and speed. More importantly, vaccines pre-pandemic were produced with different technologies.

The leading western producers mostly produce vaccines using viral vector and/or protein technology. Older inactivated virus technology is mostly used in LIC production, most notably in China. For COVID-19, the two Chinese vaccines approved by the World Health Organisation use inactivated virus technology, while vaccines from Astra Zeneca and Johnson & Johnson use viral vector technology (this includes the Serum Institute, which licenses Astra Zeneca vaccines for supply to LICs). However, the vaccines from BioNTech and Moderna use a novel mRNA technology. At the start of the COVID-19 pandemic, it was unclear how much of the established vaccine production capacity could be quickly activated for COVID-19 vaccine production, particularly for the novel mRNA vaccines.

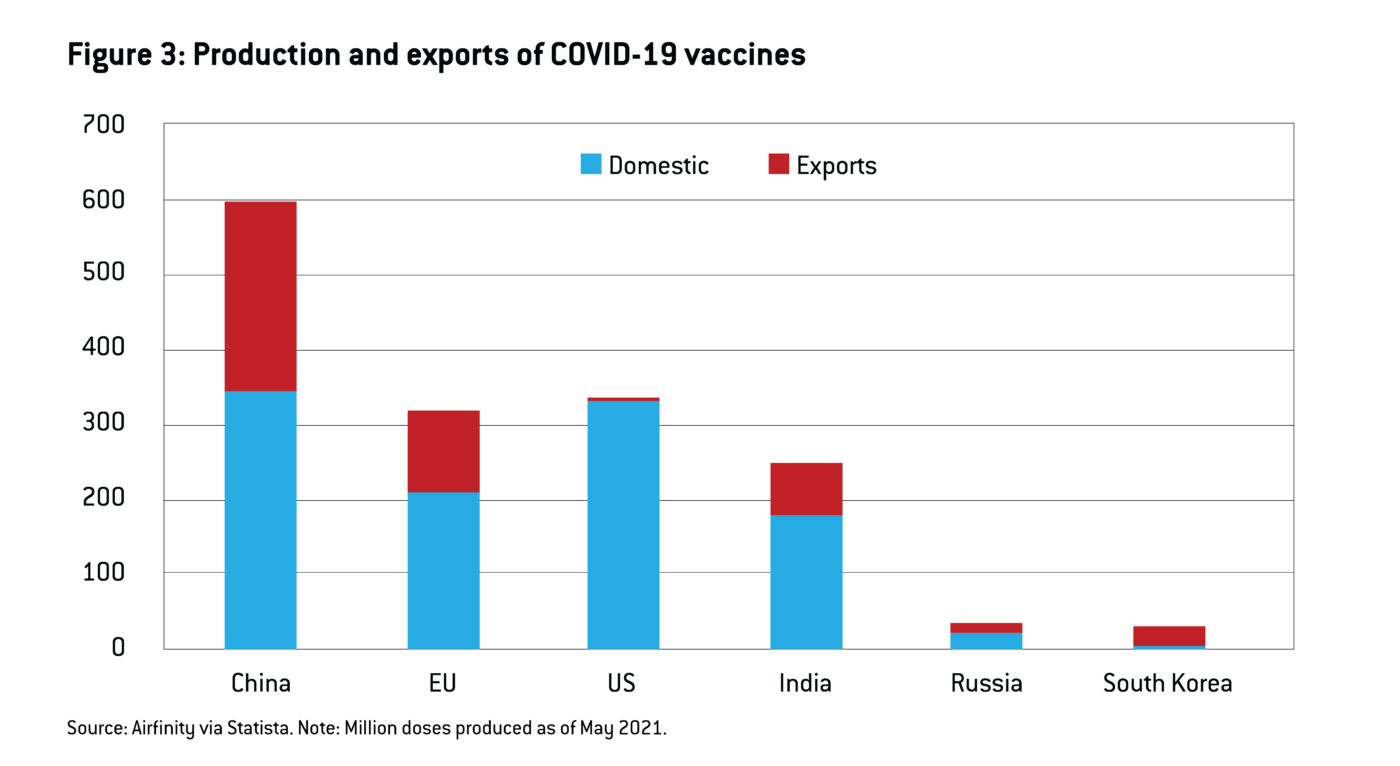

Data on COVID-19 vaccine production from Airfinity, a small private firm that specialises in COVID-19 data, shows the similarities and differences compared to the pre-pandemic situation (Figure 3). The biggest producers of COVID-19 vaccines are the same as the biggest vaccine producers before the pandemic (China, the US, the EU and India), but the ranking has changed.

A significant change can be observed in China’s vaccine policy. While China exported hardly any vaccines before the pandemic, it is now the largest exporter of COVID-19 vaccines. Chinese vaccines are mainly exported to a handful of LICs in central and South-East Asia, South America and North Africa. The US, meanwhile, is yet to export any COVID-19 vaccine, as it has prioritised vaccinating its own population first. India, which pre-pandemic was the main exporter of vaccines to LICs and could be a pivotal country for meeting LIC demand, is exporting but redirecting its capacity in order to meet local demand. Russia’s Sputnik V viral vector vaccine has received a lot of media attention, but Russia, although it is exporting more than usual, only plays a minor role in volume terms.

Figure 3: Production and exports of COVID-19 vaccines

Overall, the evidence shows that high-income vaccine producers (US, EU) have, in the pandemic, continued to produce for high-income countries (though the US currently produces only for itself). In the light of our data, it is unsurprising that keeping global vaccine markets open was less of a priority for the US than the EU, given the much greater pre-pandemic export intensity of EU vaccine production.

However, for LICs, India’s apparent big step back during the pandemic from its role of exporter could be bad news. Until now, India has been the major supplier to LICs. Interestingly, China (and Russia, to a smaller degree) has seized the opportunity to increase production and exports to LICs.

Outlook

The pressing question currently is how to increase the volume of COVID-19 vaccines available to the world and, more specifically, to low-income countries. The developing world until now has relied on India for vaccines. Can other suppliers and countries scale up in the face of India’s retrenchment in the face of the devastating COVID-19 wave in India in spring 2021? China has significantly increased its capacity and now exports massively to low-income countries, but will be constrained by the willingness of countries to take up China’s vaccines, which use the older inactivated virus technology. Even if the US changes policy and exports more of its unused capacity, this capacity is not so sizeable.

While much hope has been invested in patent waivers to increase production in LICs, it is unclear if such a policy will work in the short term, given how little experience producers have with mRNA vaccines (making even voluntary licensing deals difficult). Even for vaccines based on the old inactivated vaccine or viral vector technologies, further transfers of production know-how are needed.

This leaves the EU as the main supplier to the world, given its capacity to produce at scale the most sought-after COVID-19 vaccines. In addition, EU producers have a legacy of exporting, though mainly intra-EU or to other HICs. In the medium-term, partnerships with emerging markets will remain absolutely essential. Notable is the EU’s initiative to support the creation of vaccine production in Africa, including through mRNA manufacturing. In addition, since developing markets are not served by European manufacturers in the first place, there is little risk of harming EU industry.

Lionel Guetta-Jeanrenaud is working at Bruegel as a Research Assistant. He studied economics at the Ecole normale supérieure de Lyon, in France. Before joining Bruegel, Lionel worked as a research assistant at the Department of Economics of Harvard University.

Niclas Poitiers, a German citizen, joined Bruegel as a research fellow in September 2019. Niclas’ research interests include international trade, international macroeconomics and the digital economy. He is working on topics on e-commerce in trade as well as European trade policy in global trade wars. Furthermore he is interested in topics on income inequality and welfare state policies.

Prof Dr. Reinhilde Veugelers is a full professor at KULeuven (BE) at the Department of Management, Strategy and Innovation. She is a Senior Fellow at Bruegel since 2009. She is also a CEPR Research Fellow, a member of the Royal Flemish Academy of Belgium for Sciences and of the Academia Europeana. From 2004-2008, she was on academic leave, as advisor at the European Commission (BEPA Bureau of European Policy Analysis). She served on the ERC Scientific Council from 2012-2018 and on the RISE Expert Group advising the commissioner for Research. She is a member of VARIO, the expert group advising the Flemish minister for Innovation. She is currently a member of the Board of Reviewing Editors of the journal Science and a co-PI on the Science of Science Funding Initiative at NBER.

To read the full commentary from Bruegel, please click here.