The COVID-19 pandemic has disrupted economies and lives in general on a worldwide scale. Nevertheless, even though the pandemic is still on, this is also the time when countries should start planning for economic growth to make up for the damage caused. International trade is definitely one of the means that could help this process.

The economies of the EU’s Mediterranean Member States have been especially badly hit by the pandemic. In this context it is worthwhile posing the question as to whether one of the mainstays of the EU’s trade ambitions – the EU-Mercosur trade agreement – can bring some respite and opportunity for them. It has to be stated from the outset that the Agreement will certainly bring advantages to Mercosur as well as the EU as a whole. Nevertheless there is merit in focusing on the benefits for individual entities, such as the EU’s Mediterranean Member States.

Potential Benefits

From a precise geographical perspective, the EU’s Mediterranean is made up of Croatia, Cyprus, Greece, France, Italy, Malta, Portugal, Spain and Slovenia, even though some if these Member States are typically more “Mediterranean” than the others. The following opportunities that Mercosur might bring will be considered in the context of these Member States.

- The Agreement will bring more opportunities to the many EU Mediterranean businesses already active in Mercosur

Member States that are already trading with Mercosur might find that the Agreement will cut down on some of the barriers they currently face when trading there. This reduction in barriers might come in the form of a reduction or removal of customs duties or trade facilitation measures. In practice this can make their goods or services cheaper and more competitive in Mercosur countries, allowing them to generate more revenues or else pocket the benefits as profit. It can also make their operations more effective.

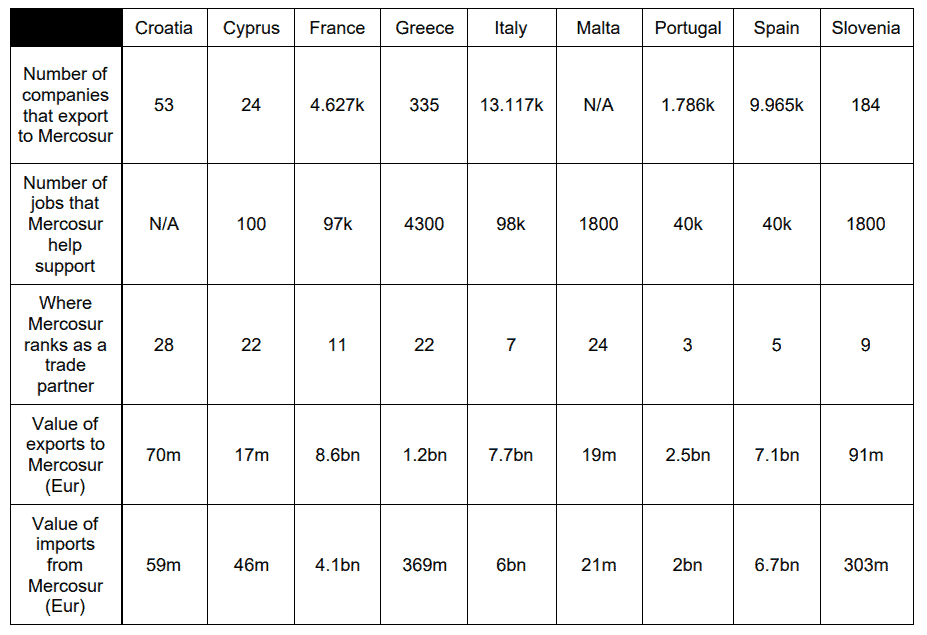

The current trade footprint of Mediterranean Member States with Mercosur can be illustrated as follows:

Table 1: Profiling trade between Mediterranean and Mercosur countries

*Source: European Commission (2021) EU-Mercosur trade in your town

It appears that the most well connected Mediterranean Member States are France, Italy, Portugal and Spain. In this regard the businesses of these countries that already have a footprint in Mercosur stand a better chance of benefitting from the opportunities that the Agreement will offer.

- Businesses in Mediterranean Member States that have cultural ties to Mercosur countries will have an edge in using new trade opportunities.

Some Mediterranean Member States have cultural ties with Mercosur that no other Member State has. The Portuguese community is the largest migrant community in Brazil (with Italians being the sixth). In Argentina, Italians are the largest European community (and sixth overall after five Latin American communities). In Uruguay, the Spanish are the second largest community while Italians are the fourth largest. In the meantime, Portugal also has strong linguistic cultural ties with Brazil, whilst Spain has strong linguistic and cultural ties with the rest of Mercosur. These connections make it easier for businesses from these Member States to use the agreement. This is especially the case when it comes to following what is going on in the market and spotting opportunities (such as those in public procurement), communicating with establish business contacts and – most of all – using the opportunities that the agreement will open in trade in services, especially when it comes to services where language plays a key role.

- The Agreement provides benefits for products where Mediterranean Member State businesses can be especially competitive.

The Agreement creates a number of opportunities for boosting trade in goods where EU Mediterranean Member States are competitive. For example, tariffs on wine and olive oil, which are currently at 27 and 10% respectively, will be removed in a staged manner. For other products such as cheese, where there currently is a tariff of 27%, there will be quotas under which the products will enter at zero duty. The same goes for other products such as tomatoes and citrus fruits. Tariffs for these products are quite high and their removal will make a big difference in making EU products more affordable in the Mercosur market or improve the premium for EU Mediterranean businesses producing these products. Beyond tariffs, the agreement will also make trading easier for agri-food exporters as it provides clearer and more transparent audit rules.

Beyond these products, the more “industrialized” Mediterranean Member States also stand to benefit. This is especially promising for France and Italy. Machines and electrical products currently attract tariffs ranging from 14% to 20%. These will eventually be reduced to zero. Tariffs on transportation equipment (such as cars, engines, trains, parts etc.) will also be removed in a staged manner. The same goes for steel and metals, plastics, rubber and textiles and medical and precision instruments.

- The Agreement protects Geographical Indications (GIs), many of which pertain to Mediterranean Member States.

The Agreement protects the following GIs from the EU’s Mediterranean Member States: 6 Croatian, 6 Cypriot, 63 French, 20 Greek, 57 Italian, 36 Portuguese, 6 Slovenian and 59 Spanish. These GIs will enjoy protection against imitations that are analogous to that received in the EU. Moreover, it will not be permissible for businesses in Mercosur countries to sell local or foreign products that use the GI-protected names. As a result, the EU producers of these GI-protected goods are presented with a promising opportunity to increase their market share in Mercosur.

5. The Agreement will make it easier for SMEs to trade

The Agreement will also make it easier for SMEs to trade as Mercosur countries will have to increase transparency, cut red tape and introduce simpler trading procedures. The Agreement also foresees coordinators for SMEs that will take into account the needs of SMEs during the implementation of the Agreement. It should be noted that this will not only benefit the EU’ Mediterranean Member States but all of the EU as SMEs by far make up the greatest number of enterprises in each Member State.

Mercosur in the Mediterranean – a silver bullet?

The Sustainability Impact Assessment (SIA) of the EU-Mercosur Agreement arrives at figures that are relatively encouraging about the economic benefits of the Agreement. In a conservative scenario, GDP in the EU as a whole will expand by EUR 10.9bn (0.1%) by 2032 in comparison to the modelling baseline without the Agreement. In an ambitious scenario, the EU GDP will expand by EUR 15bn (0.1%). The SIA does not propose which Member States will benefit the most from this growth. Nevertheless, as previously discussed, the strong connections of Mediterranean Member States with Mercosur are likely to give them positive disproportionate gains.

Other sources give more cautious estimates. A study concludes that the quantifiable gains from Mercosur are small on account of the small share of EU trade with Mercosur and the relatively modest ambitions of the deal in terms of liberalizing agriculture in the EU and manufacturing in Mercosur. Yet a more promising picture might emerge if the focus is specifically turned to Mediterranean Member States, especially France, Italy, Portugal and Spain for which Mercosur is already an important trading partner.

Conclusions

From the general considerations made in this brief article, it appears that the EU-Mercosur Agreement has the potential to support economic development in the EU’s Mediterranean Member States and help them to achieve post COVID-19 growth. The EU’s Mediterranean region and Mercosur are geographically far from each other. However their multitude of connections bring them close enough for Mediterranean Member States to benefit in ways that other Member States cannot.

The Agreement no panacea: on its own it will not provide the growth that is urgently needed to recover the losses brought about by COVID-19. The remaining hurdles in getting the Agreement approved and the staging periods for some of the mechanisms of this Agreement to come into force will also delay its benefits. Nevertheless the Agreement surely has potential to play a significant role in the Mediterranean Member States’ post COVID-19 long term recovery. They should therefore push for the Agreement to be up and running at the earliest.

Jan Micallef is an EU and International Trade Specialist and Former Trade Attaché at the Permanent Representation of Malta to the European Union

To read the full commentary from the European Centre for International Political Economy (ECIPE), please click here.