Global trade tensions have worsened and developing countries stand to see depressing investments as global uncertainty grows. On July 6, the United States implemented a first round of tariffs on $34 billion of imports from China, as part of $50 billion in announced tariffs; China retaliated with tariffs on an equivalent amount of imports from the United States. Both countries have announced the potential for additional tariffs. The new tariffs will depress bilateral trade, disrupt global supply chains, and increase demand for substitutes from other countries. Because both countries are large, there will also be terms of trade effects. The biggest effects of tariff escalation on developing countries are likely to come from depressed investment, as firms delay investments because of uncertainty over market access.

This note assesses the implications of tariffs between China and the United States on developing countries, using a Computable General Equilibrium (CGE) Model, under the following three scenarios:

- Scenario 1: 25% tariff surcharge on the $50 billion in bilateral trade by US and China;

- Scenario 2: 25% tariff surcharge on all products traded between the US and China;

- Scenario 3: 25% tariff on all products traded plus a decline in investor confidence, resulting in a 0.5 pp drop in investment to GDP.

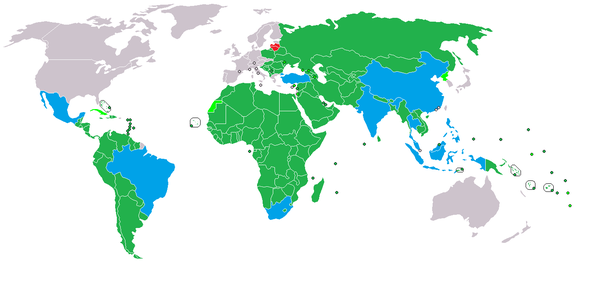

The analysis shows that a US-China tariff escalation could reduce global exports by up to 3% ($674 billion) and global income by up to 1.7% ($1.4 trillion) with losses across all regions.

- Impact on developing countries: Third party countries benefit from increased preference margins in the US and Chinese markets when the two trading partners impose tariff surcharges. But, when investor confidence is shaken, these gains are more than offset for all regions by negative income effects. In this scenario, income losses range between 0.9% for South Asia and 1.7% for Europe and Central Asia.

- Impact on China and US: The biggest declines in incomes are recorded by China and the US, up to 3.5% ($426 billion) and 1.6% ($313 billion), respectively. The sectors most affected include: agriculture, chemicals and transport equipment in the US; and electronic equipment, machinery and other manufacturing in China.

In the current uncertain global business environment, developing and developed countries need to act to retain investor confidence and avoid the disruption of trade flows and global supply chains. Developing and developed countries can improve the credibility of future policies by deepening their commitments in multilateral fora such as the WTO and regional trade agreements.

Impacts-on-Global-Trade-and-Income-of-Current-Trade-DisputesTo view the original report from The World Bank, please click here.