Fragmentation of production activity has accelerated in recent years. The global market size for outsourcing has doubled from $45.6 billion in 2000 to $92.5 billion in 2019.1 According to Grossman and Helpman (2005), firms now outsource a range of activities – jobs related to both manufacturing (such as product design, assembly, research and development) and professional services (marketing, distribution, after-sales services). Given that outsourcing has implications for employment and wages (Hummels et al. 2014), understanding its determinants is crucial for both academics and policymakers. Determinants of outsourcing include contractibility (Grossman and Helpman 2005, Alfaro et al. 2019), communication technology (Fort 2017), globalisation (Ornelas and Turner 2008, Chongvilaivan and Hur 2012, Buehler and Burghardt 2015, Stiebale and Vencappa 2018, Limão and Xu 2021), and prices (Alfaro et al. 2016).

In a recent paper (Chakraborty et al. 2021), we outline that import competition is also an important driver of outsourcing. While most studies look at foreign outsourcing, we focus on domestic outsourcing – an aspect which has largely been ignored in the literature. Additionally, we propose a novel channel that influences outsourcing of production activities by a firm. We posit that an interaction between stringent labour market regulations and an increase in import competition can incentivise firms to outsource manufacturing tasks. We investigate this channel using unique and new data on domestic outsourcing of manufacturing jobs (including to the informal sector) by Indian firms in the context of increased competition from Chinese imports as a result of China’s accession to the WTO in 2001.

Import competition and outsourcing

Panel A of Figure 1 shows that outsourcing of manufacturing jobs by Indian firms, as a ratio of the firms’ total wage bill, increased by roughly 300% between 1995-2001 and 2002-2007. Panel B shows the meteoric rise in import competition from China in the Indian market after China’s WTO accession in 2001. The share of manufacturing imports from China as a share of total manufacturing imports skyrocketed by about 400%. This trend is mirrored by the Chinese import penetration ratio, defined as the share of Chinese imports in an industry in total domestic consumption, which increased from less than 1% to almost 8% over the same period.

Panel C of Figure 1 plots a simple unconditional correlation between changes in the Chinese import penetration ratio and outsourcing of manufacturing jobs by Indian firms and shows a strong, positive relationship between the two. Our regression estimates show that this relationship is causal and economically meaningful. Greater import competition from China is associated with a significant increase in domestic outsourcing of manufacturing jobs – a ten percentage point increase in the import penetration ratio leads to 11–14% increase in the ratio of outsourcing expenses to the wage bill of a firm.

Figure 1 Chinese import penetration and outsourcing of manufacturing jobs by Indian manufacturing firms, 1995- 2007

The role of labour regulations

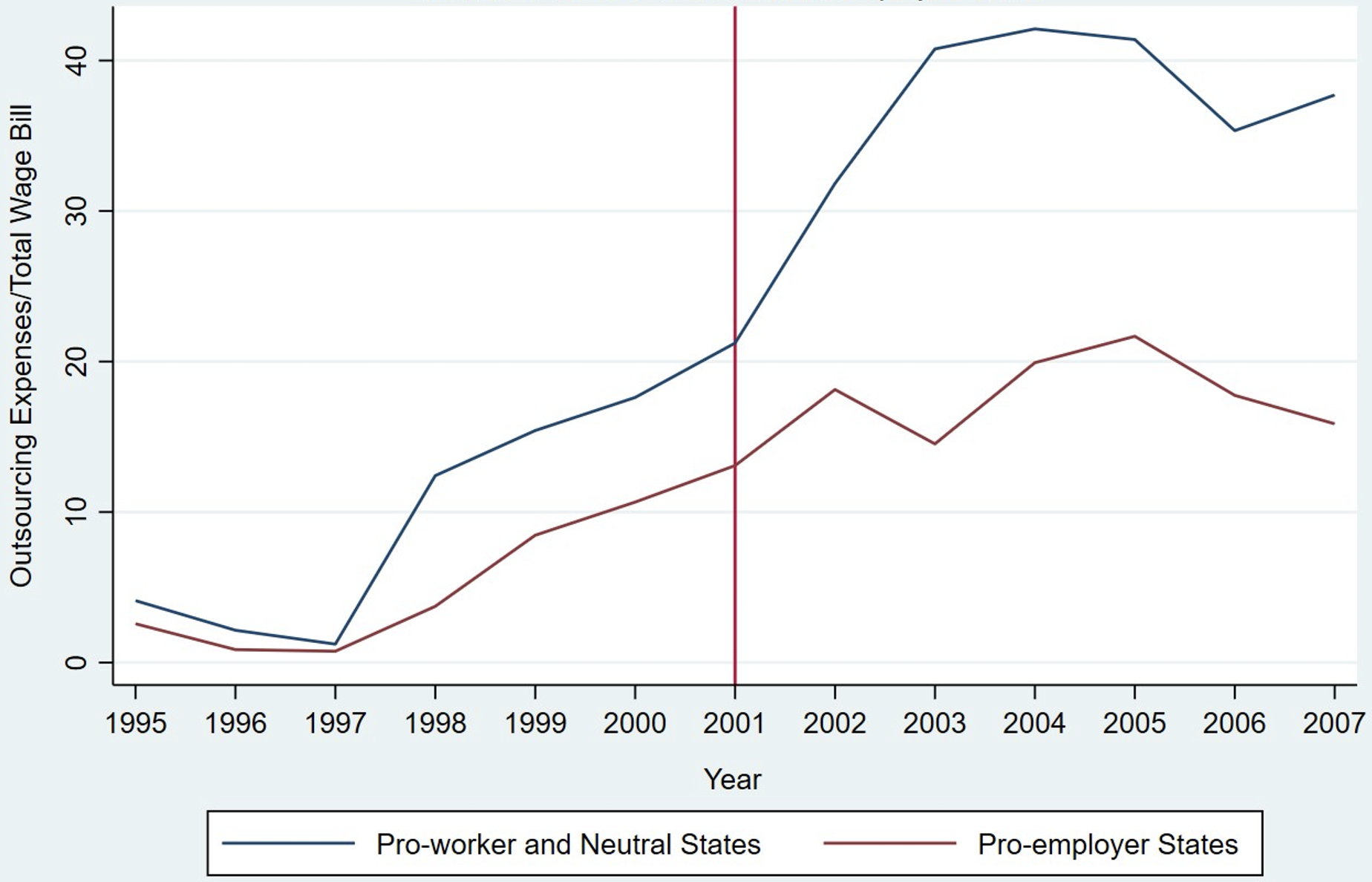

Figure 2 explores the role of labour regulation in shaping the impact of import competition on firm outsourcing. We leverage the substantial heterogeneity in labour market regulations (and their implementation) across Indian states and follow Besley and Burgess (2004), Gupta et al. (2009), and Adhvaryu et al. (2013) to classify Indian states as ‘pro-worker’ or ‘pro-employer’. Figure 2 plots the share of expenditure on outsourcing of manufacturing jobs in the total wage bill of a firm for both states with pro-employer and pro-worker (and neutral) labour laws. The plot shows that there is no clear differential trend in outsourcing between these states before 2001 – the difference in the trend starts to grow significantly along with the increase in import competition from China. Firms located in states with pro-worker labour laws start to outsource substantially more than firms in states with pro-employer labour laws after 2001. For example, the average difference in the ratio before 2001 between pro-worker and pro-employer states is around 38%, which increased to 120% between 2002 and 2007. Indeed, in our paper we show that the positive relationship between import competition and outsourcing of manufacturing jobs is relevant only for firms located in states with pro-worker labour regulations.

We interpret our results with a model where firms employ in-house labour or outsource input production at a lower wage (for instance, to the informal sector). Firms are forward-looking and recognise that they may incur firing costs to retrench or lay off workers in the next period in case of a negative demand shock. An increase in Chinese import competition results in a pro-competitive effect. In other words, relatively low-cost (productive) firms, which are the only ones with the ability to compete with imports from China, are also the ones that feel that competition and, effectively, lose their monopoly power. Their past monopoly power incentivised those firms to restrict their output and to charge high prices and markups. The loss of their monopoly power pushes them to expand output (using the standard monopoly versus competition argument) and increase outsourcing.2 This increase in outsourcing can be greater for firms in pro-worker states, since a given amount of outsourcing saves a larger amount of firing costs in the future in case a negative shock hits and firms have to contract. An implication of the model is that firm-level costs and markups (and hence, the prices charged) also decrease with an increase in outsourcing. We find empirical support for these impacts.

Figure 2 Trends in the ratio of outsourcing expenditure on manufacturing jobs to total wage bill: Pro-worker versus pro-employer states, 1995-2007

Notes: Figure plots the ratio of outsourcing expenses of manufacturing jobs in total wage bill multiplied by 100. ‘States with Pro-employer labour Laws’: Andhra Pradesh, Karnataka, Rajasthan, Tamil Nadu and Uttar Pradesh. ‘States with Pro-worker and Neutral labour Laws’: Assam, Bihar, Gujarat, Haryana, Kerela, Madhya Pradesh, Maharastra, Orissa, Punjab, and West Bengal.

The informal sector

Finally, we use data on outsourcing activity by micro enterprises in the informal manufacturing sector in India to examine the linkages between the formal and informal sectors. Firms in the informal sector face lower costs per unit of labour because labour laws are not enforced. We find that greater import competition from China is associated with an increase in the likelihood of informal enterprises selling their final output to other enterprises directly, or through a contractor. This relationship is magnified in states with pro-worker labour regulation. Our results also show that firms that are engaged in such contracts experience an increase in their output and employment. Our study thus highlights the implications of international trade for labour market outcomes and informality in developing countries (Goldberg and Pavcnik 2003, Dix-Carneiro et al. 2021).

Conclusion

We propose outsourcing as a new margin of adjustment by firms to import competition, thereby contributing to a large literature examining the impact of import competition, especially from China, on a range of outcomes in the manufacturing sector. This literature largely pertains to developed countries and focuses on the displacement of labour into unemployment, public assistance, or to other geographies. We study the movement of labour to the informal sector, which in developing countries is a means to survive, since unemployment and public assistance may not be options. By probing the role of labour market regulation in mediating the relationship between import competition and outsourcing, we underscore the significance of domestic institutions for how firms adapt to globalisation.

Pavel Chakraborty is an applied micro-economist. His research mainly focuses on the dynamics of firms in developing countries in relation to various issues regarding international trade, innovation, labour economics, organizational economics, and economic development.

Devashish Mitra is Professor of Economics and Gerald B. and Daphna Cramer Professor of Global Affairs at the Maxwell School of Citizenship and Public Affairs, Syracuse University.

Asha Sundaram is a Senior Lecturer at the Department of Economics, University of Auckland. She has an M.Phil in Economics from the University of Oxford, UK and a PhD from Syracuse University, USA.

To read the full commentary from Vox EU, please click here.