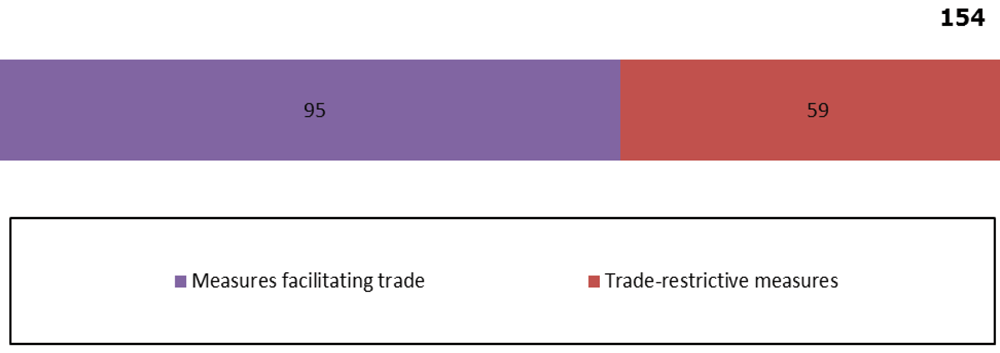

While import-restrictive measures introduced by Group of 20 (G20) economies continue to cover a growing share of trade, the WTO’s latest biannual monitoring report on trade measures — the first to cover a time period coinciding with the coronavirus pandemic — points to significant moves to facilitate imports, including products related to COVID-19. During the mid-October 2019 to mid-May 2020 review period, G20 economies implemented 154 new trade and trade-related measures, 95 of them import-facilitating and 59 import-restrictive. Of these measures, 93 (about 60 percent) were linked to the COVID-19 pandemic.

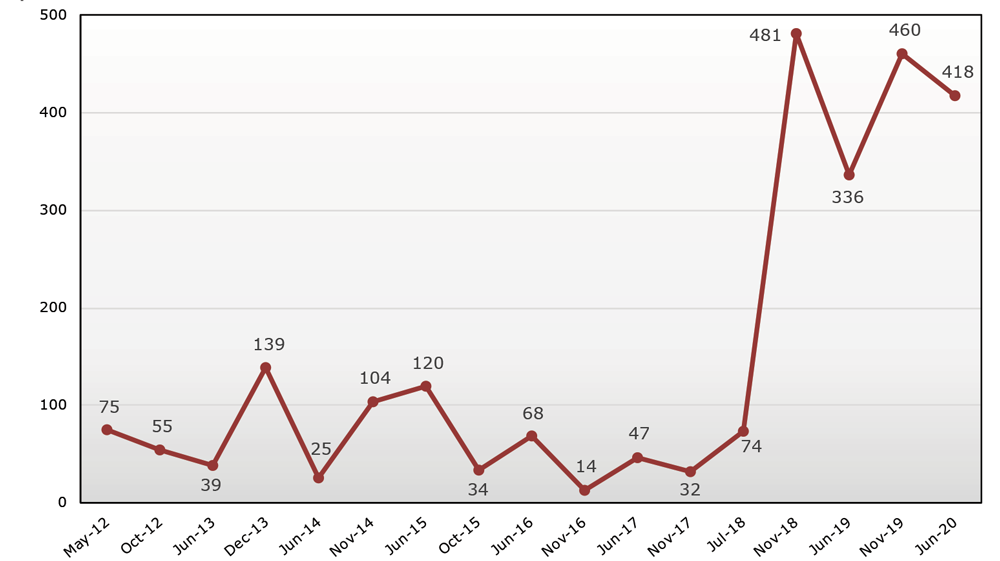

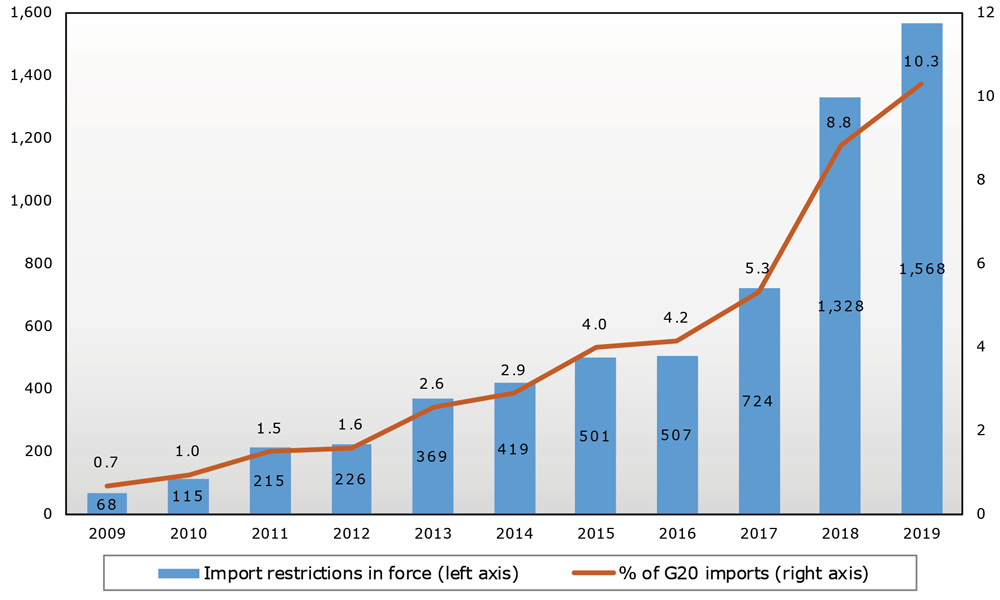

g20_joint_summary_jun20_eNew import-restrictive measures unrelated to the pandemic covered an estimated USD 417.5 billion worth of merchandise trade, the third-highest figure recorded since May 2012. Tariff increases, import bans, stricter customs procedures, export duties and other such measures introduced during the review period affected 2.8 per cent of G20 trade. Meanwhile, the stock of import-restrictive measures implemented since 2009 and still in force continues to grow – now affecting an estimated 10.3 per cent of G20 imports (USD 1.6 trillion).

However, the WTO report also finds evidence of steps towards more open trade policies across sectors, including goods, services and intellectual property.

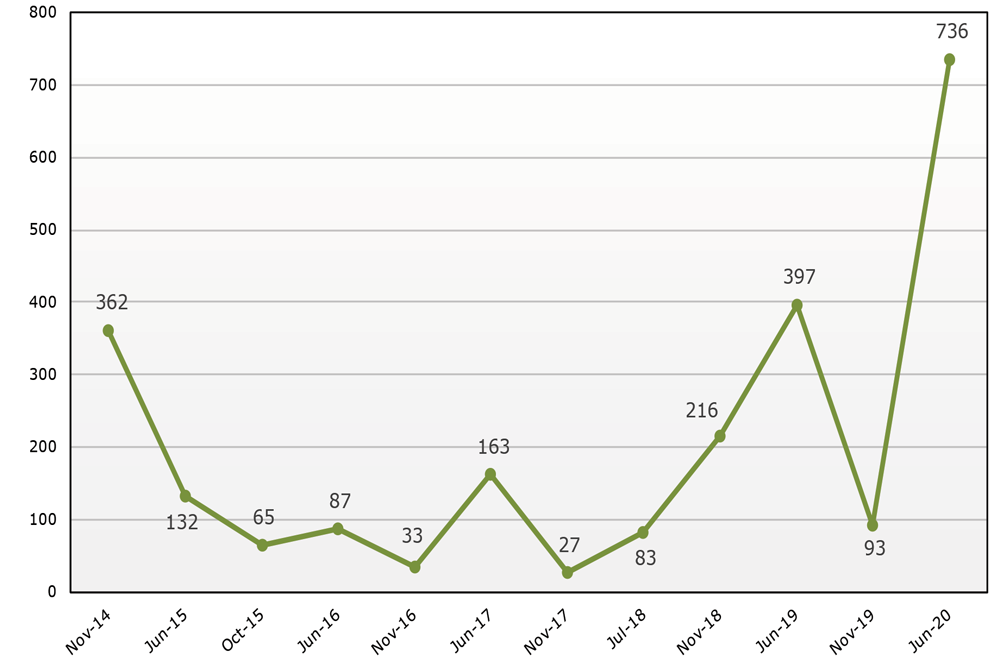

New import-facilitating measures, such as tariff reductions, the elimination of import taxes and the reduction of export duties, covered an estimated USD 735.9 billion worth of trade, excluding policies relating to the pandemic. This figure is the highest recorded since 2014, and is sharply higher than the USD 92.6 billion trade coverage of import-facilitating measures recorded during the previous monitoring period from May to October 2019.

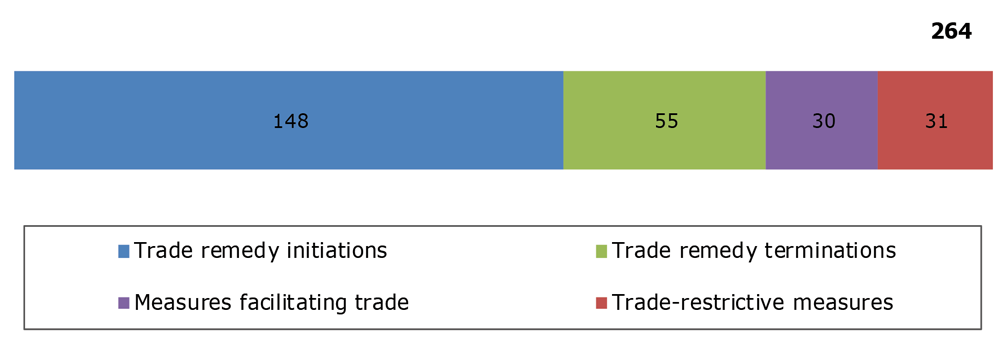

The initial COVID-19 outbreak saw many governments introduce trade restrictions, over 90 per cent of them export bans on medical products, such as surgical masks, gloves, medicine and disinfectant. Since then, G20 economies have repealed 36 per cent of these restrictions. They have also lowered barriers to imports of many pandemic-related products. As of mid-May 2020, 65 of the 93 pandemic-related trade measures implemented during the monitoring period – or about 70 per cent – were of a trade-facilitating nature. The remaining 28 measures, 30 per cent of the total, could be considered to have trade-restrictive effects.

Commenting on the report, Director-General Roberto Azevêdo said:

“Historically high levels of trade-restrictive measures remain a source of concern, all the more so at a time when international trade and investment will be critical to rebuild economies, businesses and livelihoods around the world. That said, we also see some encouraging indications: not since 2014 have import-facilitating measures implemented during a single monitoring period covered more trade.

“There are signs that trade-restrictive measures adopted in the early stages of the pandemic are starting to be rolled back. There is no room for complacency: building on these positive indicators will demand consistent efforts and leadership, starting with the G20. Exceptional circumstances require exceptional responses, and this is the time for G20 governments to work together to facilitate a rapid and inclusive economic recovery.”

The report – the 23rd in a series dating back to the global financial crisis in 2009 – was the first to be prepared against the backdrop of the COVID-19 pandemic. The full impact of the viral outbreak and associated lockdown measures is not yet reflected in trade statistics, but according to WTO data published on 22 June, world trade fell sharply in the first half of the year.

In addition to details about trade measures put in place during the review period, the report, in line with its mandate, provides details on general economic support measures put in place by governments. The new report also describes the unprecedented number and extent of emergency support measures introduced in response to the economic and social disruption caused by the COVID-19 pandemic.

Most of the 468 COVID-19-related economic support measures identified appeared to be of a temporary nature and included a broad range of support programmes, loans, credit guarantees and stimulus packages. Several measures were one-off grants, others included disbursements staggered over a period of a few months to up to three years. Some of these measures form part of emergency rescue programmes collectively worth in excess of several trillion US dollars.

The WTO trade monitoring reports have been prepared by the WTO Secretariat since 2009. G20 members are: Argentina; Australia; Brazil; Canada; China; the European Union; France; Germany; India; Indonesia; Italy; Japan; the Republic of Korea; Mexico; the Russian Federation; the Kingdom of Saudi Arabia; South Africa; Turkey; the United Kingdom; and the United States.

KEY FINDINGS

- This Report covers new trade and trade-related measures implemented by G20 economies between 16 October 2019 and 15 May 2020. This period included the start of the COVID-19 pandemic, which has already delivered an almost unprecedented shock to the global economy and caused significant social disruption. Although the full impact of the pandemic is not yet reflected fully in trade statistics, it is expected to be very substantial.

- In its trade forecast of 8 April, the WTO considered two scenarios for the crisis, one relatively optimistic and the other more pessimistic. Under the optimistic scenario, the volume of world merchandise trade would fall by 12.9 per cent and world GDP would decline by 2.5 per cent. Under the pessimistic scenario, trade would contract by 31.9 per cent and GDP would shrink by 8.8 per cent. As of mid-June, preliminary trade data and trade-related indicators for the first half of 2020 are more consistent with the optimistic scenario than the pessimistic one but actual outcomes could easily fall within or even outside of the forecast range, depending on how the crisis unfolds.

- World trade was already slowing before the pandemic struck, weighed down by heightened trade tensions and slowing global economic growth. Merchandise trade was down 0.1 per cent in volume terms in 2019, marking the first decline since 2009. Trade growth also slowed in nominal terms in 2019, as the dollar value of merchandise exports fell by 3 per cent to USD 18.89 trillion. Although commercial services exports increased by 2 per cent to USD 6.03 trillion in 2019, the pace of growth was down sharply from 9 per cent in the previous year.

- Overall, G20 economies implemented 154 new trade and trade-related measures during the review period, of which 95 were of a trade-facilitating nature and 59 were trade-restrictive. Sixty per cent of these measures (93 in total) were linked to the COVID-19 pandemic. Of these 93 measures, 65 facilitated trade while 28 restricted trade. In the early stages of the pandemic, several of the measures introduced by G20 economies restricted the free flow of trade, principally for exports. But as of mid-May 2020, 70 per cent of all COVID-19 related measures were trade-facilitating. Of the pandemic-related trade restrictions recorded, export bans accounted for more than 90 per cent. Around 36 per cent of the COVID-19 specific trade restrictions implemented by G20 economies had been repealed by mid-May.

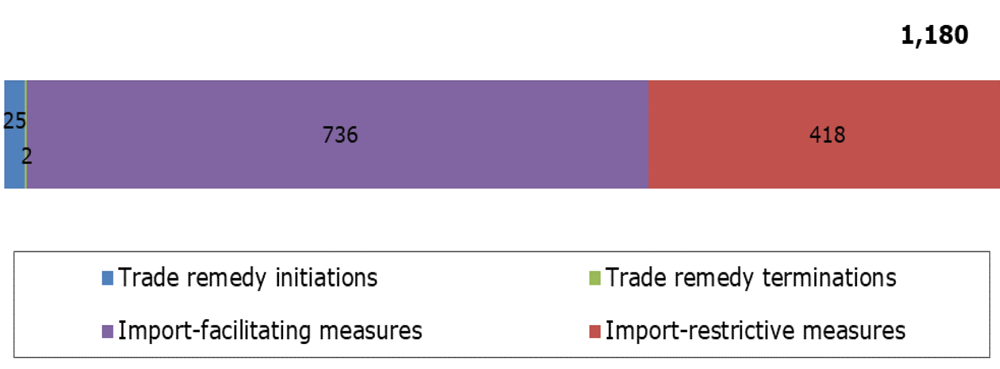

- Excluding COVID-19-related measures, G20 economies implemented 61 trade and trade-related measures during the review period. These included 30 new measures aimed at facilitating trade during the review period. The trade coverage of these non-COVID-19 related import-facilitating measures implemented during the review period was estimated at USD 735.9 billion, the highest figure for such measures since November 2014. G20 economies also put in place 31 new trade-restrictive measures unrelated to the pandemic. The trade coverage for these new import-restrictive measures was estimated at USD 417.5 billion – the third-highest value recorded since May 2012. The trade coverage of import restrictive measures has soared since May 2018 as a result of global trade tensions. It is estimated that 2.8 per cent of G20 trade was affected by import-restrictive measures implemented during the current review period. Import-restrictive measures implemented since 2009 and still in force affect an estimated 10.3 per cent of G20 imports (USD 1.6 trillion).

- All WTO issues regularly covered by this Report saw significant activity both before and after the outbreak of the COVID-19 pandemic. During the review period, 203 trade remedy actions were recorded for G20 economies. The monthly average of trade remedy actions initiated was slightly higher than the average for the last eight years while the monthly average of trade remedy terminations was the lowest over the same time span. During the review period, initiations of anti-dumping investigations accounted for around 80 per cent of all trade remedy initiations, which also includes safeguards and countervailing actions.

- In services, most of the new measures introduced by G20 economies between mid-October 2019 and mid-May 2020 were trade facilitating, but a number of new policies appeared to be trade restrictive, including in areas related to foreign investment and in areas considered strategic or linked to national security. Most of the 51 services measures adopted by G20 economies in response to the pandemic appeared to be trade-facilitating.

- G20 economies continued to implement general economic support measures as part of their overall trade policy, a fact confirmed by Secretariat analysis despite governments’ low response rate with respect to these measures. In addition, G20 economies also implemented a large number of emergency support measures in response to the economic and social turmoil caused by the COVID-19 pandemic. Most of the 468 COVID-19 related general economic support measures identified, including monetary, fiscal and financial measures as well as preferential loans, credit guarantees, and stimulus packages, collectively worth several trillion US dollars, appeared to be temporary in nature. These emergency support measures are central to governments’ strategies to address the pandemic-induced economic downturn and to prepare the ground for a strong recovery. Regular monitoring of support measures introduced in the context of the COVID-19 pandemic will be important for members to be able to track their evolution and effects as the world exits the health crisis and enters a recovery period.

- G20 economies continued to be very active in notifying their sanitary and phytosanitary (SPS) measures, accounting for 66 per cent of all regular notifications and 35 per cent of emergency notifications since 1995. From 1 February until 15 May 2020, ten G20 economies submitted 15 SPS notifications and communications related to measures taken in response to the pandemic. The nature of most of these measures has shifted, from initial restrictions on animal imports and/or transit from affected areas and additional certification requirements, to, as of April, trade-facilitating measures such as the use of electronic certificates for checks. Similarly, G20 economies are the most frequent users of the Technical Barriers to Trade (TBT) Committee’s transparency mechanisms. As of 15 May 2020, G20 economies had submitted 20 COVID-19 related TBT notifications, covering a wide range of products including personal protective equipment (PPE), medical equipment, medical supplies, medicines and food.

- Most questions raised in the Committee on Agriculture during the review period focused on policies implemented by G20 economies. In relation to the COVID-19 pandemic, three WTO members informed the WTO of temporary measures to respond to food security threats.

- The Report also covers developments in G20 economies in trade-related aspects of intellectual property rights (TRIPS). Several G20 members implemented specific IP-related measures aimed at facilitating the development and dissemination of COVID-19 related health technologies, as well as at relaxing procedural requirements and extending deadlines for administrative IP matters.

- Work continued in the first months of 2020 to advance negotiations, particularly on fisheries subsidies, building on the decision taken by members at the WTO’s 11th Ministerial Conference in late 2017. Groups of members also continued to pursue discussions on other issues, including electronic commerce, investment facilitation, women’s economic empowerment, domestic regulation in services and micro, small and medium-sized enterprises (MSMEs). However, delegations’ ability to engage in detailed negotiations has been constrained by restrictions on movement and the refocusing of priorities on addressing the COVID-19 pandemic.

G20 trade-facilitating and trade-restrictive measures, mid-October 2019 to mid-May 2020

(By number)

Note: Including COVID-19 trade and trade-related measures.

Source: WTO Secretariat.

G20 COVID-19 trade and trade-related measures, by mid-May 2020

(By number)

Source: WTO Secretariat.

G20 trade and trade-related measures, mid-October 2019 to mid-May 2020

(By number)

Note: COVID-19 trade and trade-related measures are not included.

Source: WTO Secretariat.

Trade coverage of G20 measures, mid-October 2019 to mid-May 2020

(USD billion)

Note: COVID-19 trade and trade-related measures are not included.

Source: WTO Secretariat.

Trade coverage of new import-facilitating measures in each reporting period

(not cumulative)

(USD billion)

Note: These figures are estimates and represent the trade coverage of the measures (i.e. annual imports of the products concerned from economies affected by the measures) and not the cumulative impact of the trade measures. Liberalization associated with the 2015 Expansion of the WTO’s Information Technology Agreement is not included in the figures. COVID-19 trade and trade-related measures are not included.

Source: WTO Secretariat.

Trade coverage of new import-restrictive measures in each reporting period

(not cumulative)

(USD billion)

Note: These figures are estimates and represent the trade coverage of the measures (i.e. annual imports of the products concerned from economies affected by the measures) introduced during each reporting period, and not the cumulative impact of the trade measures. COVID-19 trade and trade-related measures are not included.

Source: WTO Secretariat.

Cumulative trade coverage of G20 import-restrictive measures in force since 2009

(USD billion and % of world merchandise imports)

To read the original report at the World Trade Organization, please click here