Amid Brexit and protectionist moves by President Trump, many observers are warning about the negative effects that a rise in trade barriers could have on growth. This column first highlights the important role acquired by deep-water ports as main hubs for trade during 1995-2007 and how they have allowed countries to gain from trade. It then shows that becoming embedded in global value chains is a powerful determinant of growth, even if it implies that a growing share of gross exports represents value added that has been produced in foreign countries.

The recent protectionist moves by President Trump and the Brexit negotiations have revamped the debate about the benefits of trade. Many observers are warning about the negative effects that a rise in trade barriers could have on growth, especially on the grounds that national economies have become deeply connected through global value chains (GVCs). Yet, we still know little about the growth implications of GVCs. Indeed, none of the available studies investigating the causal effect of international trade on growth focuses on this issue.

As production processes are sliced up across different countries through GVCs, the gross exports of any country embody an increasing share of foreign value added. Moreover, there is substantial double counting in trade figures, as intermediate inputs cross borders multiple times before consumption takes place.

Finally, countries are different in the extent to which they participate in global value chains, and also in their positioning within them, i.e. from assembling to more upstream stages of the production chain. In a recent paper (Altomonte et al. 2018), we set out to investigate the implications of these phenomena for the trade-growth nexus.

We focus on the pre-crisis period 1995-2007, which has witnessed a rapid expansion of GVCs. We develop a new instrument for gross trade and for the different value-added components of exports. To this purpose, we exploit the transportation shock provided by the sharp increase in the maximum size of container ships. We find that trade has a positive effect on growth.

Most importantly, we show that the effect of exports is crucially moderated by differences in their value-added composition. In particular, we find evidence of stronger export effects on growth for countries that upgrade their positioning or improve their participation to GVCs more than others over time.

The transportation shock

Assessing the causal impact of trade on growth is a notoriously difficult exercise due to the endogeneity of trade. For instance, countries whose income grows more for reasons that are not related to trade may still engage in more trade. Several instrumental variable strategies have been adopted in this context. In line with the most recent studies, we construct our instrument for trade by exploiting a shock to transportation technology that has an asymmetric impact across different bilateral trade flows.

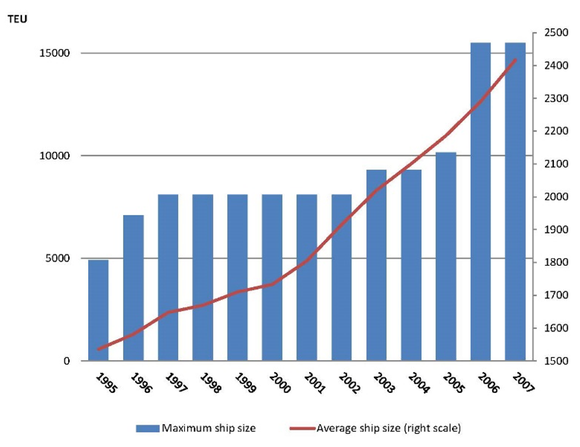

As a shock, we exploit the fact that the maximum size of container ships has more than tripled over the sample period, from about 5,000 to 15,500 TEU (twenty-foot equivalent units, corresponding to one standard container) (see Figure 1). This technological shift has been a game changer for the transportation industry, allowing for substantial economies of scale.

The new larger ships available have been widely adopted, leading to a rapid growth in the average capacity of the world container ships fleet, which has increased by 60%, from about 1,500 to around 2,400 TEU (see Figure 1). As a result, containerised trade has been the fastest growing modality of seaborne trade over the sample, ultimately accounting for about 40% of total trade.

This transportation shock has affected different trade flows asymmetrically, depending on the cross-country presence of deep-water ports, i.e. ports with a water depth of at least 16 metres. In fact, the new larger ships have a bigger draft and therefore can only enter deeper ports, which are unevenly distributed across countries.

As a result, in a relatively short time, a restricted group of pre-existing deep-water ports has become increasingly central for global trade. In particular, in the sample of 40 countries in the World Input-Output Database (WIOD) that constitute the main focus of our analysis, we have identified only 47 deep-water ports with a container terminal where all the new ships introduced over the sample period could operate.

Figure 1 Development of container ships, 1995-2007 (TEU)

Our baseline analysis involves regressing the GDP per capita of the exporting country on its exports. We construct our instrument by predicting export flows from gravity estimations that include the product between the time-varying maximum size of container ships available in the market and the time-invariant number of deep-water ports in each partner country (normalised by the length of its coast).

The basic intuition is that, as larger ships become available, countries export relatively more towards partner countries that are more endowed with deep-water ports. The identifying assumption is that, conditional on controls, the presence of deep-water ports in partner countries – combined with the increase in the size of container ships – affects domestic GDP in the exporting country only through the trade channel.

We allow the impact of the shock to be different across industries, as containerised trade has not the same relevance in all industries. Moreover, we allow for heterogeneity across country pairs based on bilateral characteristics such as distance, as containerised trade is more cost effective at longer distances.

Our baseline gravity estimates imply that for a country like Germany, which has 3,624 kilometres of coast, one additional deep-water port would be associated, on average, with an increase in yearly exports directed to the country by around 4.7%. This is far from negligible.

Policy implications

Our results have important policy implications. First, they suggest that the positive effects of trade on growth remain relevant and are not necessarily weakened by the expansion of GVCs. Getting embedded in global value chains seems to be a powerful determinant of growth, even if it implies that a growing share of gross exports represents value added that has been produced in foreign countries.

Moreover, exports have a positive effect on GDP growth even for countries that are not displaying substantial upgrades in positioning within GVCs over the sample, although climbing the value chain results in growth premia. Second, investing in physical infrastructures to facilitate trade seems to be key.

Our results highlight the important role acquired by deep-water ports as main hubs for trade over the sample period. In light of our findings, the widespread investments observed in more recent years for the creation of new deep-water ports appear as a well-motivated and important step for trade facilitation and growth.

To view the full blog, click here.