For decades, low-cost supply with minimal inventory were the key tenets of supply chain management. Lean manufacturing and just-in-time delivery were how companies across the globe achieved cost control and production efficiency.

For many major companies, China has been the key component of their supply-chain strategy. But while the earlier part of the decade was relatively static in terms of production and share of exports, some significant swings from China to other emerging markets started to be seen in 2018 and 2019.

In the consumer goods sector, for example, China’s share of global exports fell four percentage points to 42% in one year, while the figure picked up across Southeast Asia, Latin America, and Europe.

While the simplistic view is that that production is moving out of China, a closer look into the data shows a complex picture of a new, more agile landscape emerging. It is being affected as much by specific sector issues — led by geopolitics, sustainability concerns and the desire to bring essential production onshore — as it is by labour costs and tax incentives.

“Pre-emptive risk management and much deeper data analytics” need to be integrated into supply chains, says Anne Petterd, head of the international commercial and trade practice in Asia Pacific with Baker McKenzie. (Photo: Michael Leadbetter)

Recent developments, experts say, clearly illustrate how the relocation and reorganisation of global supply chains is under way, and how it is being accelerated further by the Covid-19 pandemic.

“The global supply chain faces historic disruption. We will see more change in the next five years than in the last 20,” said Ben Simpfendorfer, the founder and CEO of the strategy consultancy Silk Road Associates (SRA).

“We are moving to a new model entirely shaped by competing forces, from US-China trade tensions, to Covid-19, to rising automation and digitisation.”

While many companies in the short term are looking to secure lower-cost suppliers in the interest of financial health and survival, businesses are seeing increased incentive to do more production in their home countries, or onshoring as it’s come to be known.

In longer term, businesses increasingly see the need for a more fundamental reimagining of supply chains. The supply-side shocks that characterised the early part of the pandemic have compelled many companies to prepare for substantive supply chain restructuring. The combination of all of these factors will result in a very different supply chain landscape by the mid-2020s, Mr Simpfendorfer said.

At the same time, the digital transformation of supply chains is accelerating. According to a joint report by the law firm Baker McKenzie and SRA, as workplace technology has made great strides due to the pandemic, so too will the management of global supply chains. Businesses will increasingly combine geospatial technologies with artificial intelligence (AI) to identify potential risks, bottlenecks and underperformance in their supply chains.

“Leading multinationals will likely look to integrating pre-emptive risk management and much deeper data analytics into their supply chains,” said Anne Petterd, head of the international commercial and trade practice in Asia Pacific for Baker McKenzie.

“Being able to fully map their supply chain to understand the geographic location of suppliers and feed the maps with alternative data, such as natural disasters or lockdowns, can help companies to have in-built defences against large shocks to their supplier ecosystems.”

Businesses are therefore increasingly likely to move away from reliance on a single supplier in a high-risk location (such as a flood-prone industrial park) or on a cluster of suppliers all located in the same concentrated area, she added.

AGILITY ADVANTAGE

For multinationals, the crisis has exposed the vulnerabilities of complex global supply chains built on lean manufacturing principles. At Unilever, a multinational consumer goods company, the key lesson learned since Covid-19 erupted in January is to have a supply chain that is well diversified, resilient and digitised.

“Logistics are extremely critical for us because several lanes are broken,” said Amit Mohta, Unilever’s vice-president of procurement for Asia, recalling the unprecedented challenges the company encountered when the coronavirus outbreak began in China.

“Whenever we do a disaster recovery plan, we’ve never planned for all the world being locked down. This was a unique moment,” he told an online forum hosted by London-based Standard Chartered Bank recently.

While China is the factory of the world, Unilever is based in nearly every part of the world. In that sense, it gives the company a natural hedge for sourcing from a wide variety of sourcing.

But the emerging issue is that several markets and governments are trying to be more cost-efficient and self-sufficient, partly to reduce logistics costs. Geopolitics is also a factor.

“We cannot control customers’ behaviour. What is essential is to make our supply chain more agile and be able to track how the demand is moving and reflects back in our production,” Mr Mohta said. Unilever’s logistics system, he said, is thus designed to store and move products in the most efficient way.

Kelvin Leung, CEO of DHL Global Forwarding Asia, said the importance of digitisation has been underlined by the events of this year.

Compared to previous business disruptions such as the tsunami in Japan, floods in Thailand and Sars, this year has brought “a total disruption literally across the whole world”, he told the forum.

As major airlines cut passenger flights by 90% as passenger travel collapsed, more than half of the global uplift capacity of air freight also vanished.

“We don’t expect passenger traffic to come back in the near term even for this year-end Christmas-New Year holiday,” said Mr Leung. “That means that until the end of this year, on the supply side, I think uplift capacity will be far lower than the pre-Covid level.”

Demand is coming back but it might not be back to normal in 2021. That will put logistics costs higher than pre-Covid levels until things start to get back to normal a year later.

“Covid is really giving a big boost to digital transformation. We are having no choice but to go virtual and digital,” he said.

“This is a good opportunity to change the ways we operate to improve efficiency, especially among governments, for example, paperless connectivity and standardised documentation. It’s a good opportunity to push this agenda forward.”

ASEAN GAINS & CHALLENGES

According to the Baker-SRA study, which examined export market share across 350 product categories and 150 countries, China has a growing importance to key sectors, especially industrials, manufacturing and transport (IMT) as well as energy, mining and infrastructure (EMI).

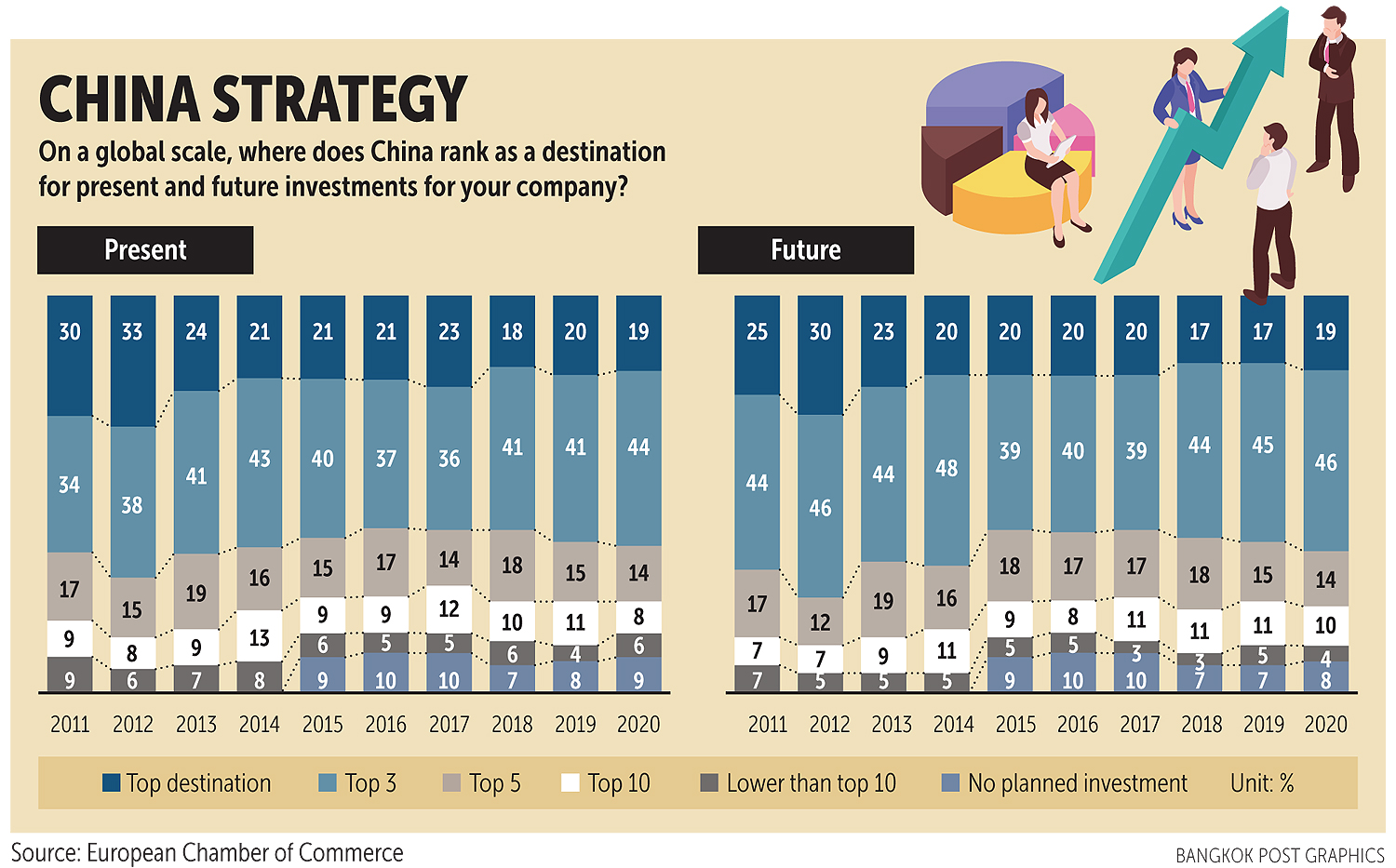

Respondents from American, European and Japanese firms cited China’s large and growing market as a reason to retain manufacturing there. A European Chamber of Commerce Business Confidence Survey in June 2020 showed that 65% members still rank China among their top three destinations for new investment.

“China will take heart that while some low-cost manufacturing activities continue to shift to other geographies, in certain areas where China has a strategic focus, such as the energy, mining and infrastructure equipment space, they are actually gaining export market share, in part fuelled by the Belt & Road Initiative,” the report stated.

In Southeast Asia, meanwhile, manufacturing capacity including land, labour and logistics will determine potential growth as a supply chain hub. Latin America is another alternative for fast-moving buyers. In particular, Mexico has been capturing global export market share, helped in part by the United States-Mexico-Canada Agreement that is reducing barriers to trade.

“Thailand has benefitted from a four-point drop in China’s global share of consumer goods and retail exports, and plays a major role in driving export growth in Southeast Asia,” said Ms Petterd of Baker McKenzie.

“The report also identifies the opportunities for the country as it becomes one of the sought after targets of renewed sourcing models.”

Asean is growing in attractiveness given a large market size of 630 million, a rising middle class and a young workforce, says Chow Wan Thonh, Regional Head of Client Coverage, Corporate, Commercial & Institutional Banking ASEAN and South Asia Standard Chartered.

“We see clients are trying to make sure that they have a much more secure, diversified and sustainable supply chain,” she said, adding that Asean can complement China under the China Plus One strategy for some corporate clients.

“Vietnam has already come back to pre-Covid levels given the rising tension between the US and China, and China’s costs. Today, the electronics industry is already pretty big in Malaysia and Vietnam, while Indonesia is pretty attractive for commodities. Every (Asean) country has unique attractions to individual industries.”

Moody’s Investors Service agreed that risk mitigation will lead to reduced dependence on China in global value chains and diversification will benefit Asean. However, localisation of production will potentially have negative effects for some Asean producers.

Specifically, trade diversification is likely to favour Asean economies over time, while the reshoring of supply chains closer to consumer markets — especially in sectors with heightened security requirements such as pharmaceuticals — could move productive capacity away, the credit rating agency said.

“Covid is really giving a big boost to digital transformation. We are having no choice but to go virtual and digital,” says Kelvin Leung, CEO of DHL Global Forwarding Asia.

“We expect many governments and companies will reduce their dependence on China in global value chains moving forward, driven by the coronavirus outbreak, the China-US trade conflict, and heightened national concerns over economic security,” said Deborah Tan, a Moody’s assistant vice-president and analyst.

“While the technological capabilities of the Asean region still lag those of more advanced Asian economies, particularly in electronics, a general openness to foreign direct investment and lower production costs will offer some advantages.”

Ms Tan said Asean economies need to mitigate the impact of a possible reshoring trend and the associated fragmentation of the global trading system. The bloc, she said, should enhance free trade agreements with advanced economies, deepen regional trade agreements in Asean itself, and develop Asean further as a trading bloc in its own right. “However, for the latter, Asean will first need to address structural challenges to harness the bloc’s full potential.”

“We see clients are trying to make sure that they have a much more secure, diversified and sustainable supply chain,” says Chow Wan Thonh, Regional Head of Client Coverage, Corporate, Commercial & Institutional Banking ASEAN and South Asia Standard Chartered.

GEOPOLITICAL FACTORS

It is no surprise that intensified geopolitical tensions such as the South China Sea conflict and deteriorating US-China trade relations are also among the factors that are driving companies to review their supply chains. Besides Asean, Taiwan has been one of the beneficiaries of this strategy.

Taiwan sits squarely in the middle of the worsening dispute between Beijing and Washington, with many of its companies operating China-based factories manufacturing for American companies. Those tensions are pushing Taiwanese companies to relocate some production back home and also redirecting money to factories on their side of the strait.

Taiwan’s government, meanwhile, has helped with tax breaks and other support, and that investment has cushioned some of the blows from the pandemic, which the island republic has managed very well. Now, government data shows that that its drive to lure firms from China is paying off.

Since January 2019, more than NT$1.1 trillion (US$38 billion) of Taiwanese investment has come back, Economic Affairs Minister Wang Mei-hua said last week, with tech manufacturers including Innolux Corp, Accton Technology Corp and Quanta Computer Inc among those building new factories in Taiwan.

Supply chains for electric vehicle manufacturers including Tesla Inc, which has a factory in Shanghai, are also moving to set up in Taiwan, she said, touting the fruits of the government’s policy to bring manufacturing and investment back.

“The global supply chain faces historic disruption. We will see more change in the next five years than in the last 20,” says Ben Simpfendorfer, founder and CEO of Silk Road Associates. (Photo: KENNETH LIM)

The moves by Taiwanese companies are in contrast with those of US firms, which haven’t responded to President Donald Trump’s calls to return home. However, rising distrust of China is leading American companies to move their supply chains elsewhere, with Ms Wang saying the main driver for companies coming back to Taiwan is intellectual property concerns from US customers.

“It’s upstream companies that determine the direction of Taiwanese investment,” noted Roy Chun Lee, deputy executive director of the Taiwan WTO & RTA Center at the Chung-Hua Institution for Economic Research. “The general trend is the creation of a second-track supply chain that is less reliant on China.”

One example is Wistron NeWeb Corp, which announced a new NT$2.7-billion investment in a factory in Taiwan in June, after its customers requested it diversify where it manufactures. The maker of routers and other wireless gear counts US-based AT&T and HP among its biggest clients.

There has also been a shift in sectors from information and communications technology, which dominated last year, with investment in compound materials and auto parts and components rising, according to Mr Lee.

Another recent change is that it’s not just American end-clients pushing companies back home to Taiwan’s skilled labour pool and highly developed supply network. “European companies are now beginning to follow their American counterparts and recommending that their suppliers diversify away from China,” he added.

Nareerat Wiriyapong is the acting Asia Focus Editor at Bangkok Post.

To read the original blog, click here.