As reported in prior posts, both China and the U.S. have taken steps to implement parts of the Phase 1 Agreement that took effect on February 14, 2020. The big question mark on the Phase 1 Agreement has to do with whether the agreement to increase imports from the United States is likely to be met.

Prior posts on the U.S.-China Phase 1 Agreement can be found here: August 8, 2020, U.S.-China Phase 1 trade agreement – review of U.S. domestic exports through June 2020, https://currentthoughtsontrade.com/2020/08/08/u-s-china-phase-1-trade-agreement-review-of-u-s-domestic-exports-through-june-2020/; July 10, 2020, U.S.-China Phase 1 Trade Agreement – limited progress on increased U.S. exports to China (through May), https://currentthoughtsontrade.com/2020/07/10/u-s-china-phase-1-trade-agreement-limited-progress-on-increased-u-s-exports-to-china-through-may/; June 5, 2020, U.S.-China Phase I Deal is Failing Expanded U.S. Exports Even Before Recent Efforts by China to Limit Certain U.S. Agriculture Exports as Retaliation for U.S. Position on Hong Kong, https://currentthoughtsontrade.com/2020/06/05/u-s-china-phase-i-deal-is-failing-expanded-u-s-exports-even-before-recent-efforts-by-china-to-limit-certain-u-s-agriculture-exports-as-retaliation-for-u-s-position-on-hong-kong/; May 12, 2020, U.S.-China Phase I Agreement – some progress on structural changes; far behind on trade in goods and services, https://currentthoughtsontrade.com/2020/05/12/u-s-china-phase-i-agreement-some-progress-on-structural-changes-far-behind-on-trade-in-goods-and-services/; January 19, 2020, U.S.-China Phase 1 Agreement – Details on the Expanding Trade Chapter, https://currentthoughtsontrade.com/2020/01/19/u-s-china-phase-1-agreement-details-on-the-expanding-trade-chapter/; January 15, 2020, U.S.-China Phase 1 Trade Agreement Signed on January 15 – An Impressive Agreement if Enforced, https://currentthoughtsontrade.com/2020/01/15/u-s-china-phase-1-trade-agreement-signed-on-january-15-an-impressive-agreement-if-enforced/.

An unusual aspect of the Phase 1 Agreement is agreement by China to increase imports from the United States of various categories of goods and services during the first two years of the Agreement with 18 categories of goods grouped in three broad categories (manufactured goods, agriculture and energy) and five services categories. Chinese imports of goods and services from the United States under the Agreement are supposed to increase by $76.7 billion in the first year over levels achieved in 2017 and in the second year by $123.3 billion over 2017 levels. The categories and tariff items included in the goods categories are reviewed in Annex 6.1 of the Agreement and the attachment to Annex 6.1. In the confidential version of the agreement, growth levels are provided for each of the 23 categories of goods and services.

While the COVID-19 pandemic has affected trade flows for most countries including both China and the United States and while bilateral relations between the U.S. and China have deteriorated since the signing of the Phase 1 Agreement, the U.S. continues to report that China intends to honor its purchase commitments in this first year (assumed to be February 14, 2020-February 13, 2021).

A six month review of progress on the overall Phase 1 Agreement by the U.S. and China was held by phone on August 24, 2020. The U.S. Trade Representative’s summary of the call is copied below and can be found here – https://ustr.gov/about-us/policy-offices/press-office/press-releases/2020/august/statement-call-between-united-states-and-china.

“Statement on Call Between the United States and China”

08/24/2020

“Washington, DC – Ambassador Lighthizer and Secretary Mnuchin participated in a regularly scheduled call this evening with China’s Vice Premier Liu He to discuss implementation of the historic Phase One Agreement between the United States and China. The parties addressed steps that China has taken to effectuate structural changes called for by the

Agreement that will ensure greater protection for intellectual property rights, remove impediments to American companies in the areas of financial services and agriculture, and eliminate forced technology transfer. The parties also discussed the significant increases in purchases of U.S. products by China as well as future actions needed to implement the agreement. Both sides see progress and are committed to taking the steps necessary to ensure the success of the agreement.”

As reviewed in earlier posts, some goods categories have data issues on the U.S. side (aircraft (orders and deliveries) show $0 exports for the entire period between 2017 and July 2020). Moreover, Amb. Lighthizer has testified to Congress that China has made some large agricultural purchases for shipments later in the year that don’t show up in the U.S. export data at the present time. Similarly, U.S. export data on services are available quarterly for some of the relevant categories and annually for certain information. However, services trade data with China for 2020 are not yet available. Total U.S. exports of services in the first half of 2020 to all countries was down 14.83%. Travel services were down more sharply, 46.32%. While the Phase 1 Agreement has large increases in U.S. services exports in the first year of the agreement ($12.8 billion over 2017 levels), the data doesn’t presently exist to measure progress on services under the Phase 1 Agreement, though it is believed that China is far behind on its commitments to increase U.S. exports of services.

Looking just at U.S. domestic export data for goods to China for the period March – July 2020, China is far behind meeting the ambitious purchase commitments made with the United States for the first year of the Agreement.

Looking at total U.S. domestic exports to China for the period March-July 2020, U.S. exports were $38.963 billion ($7.792 billion/month) compared to $45.054 billion in 2017 ($9.011 billion/month). These include both products covered by the Annex 6.1 commitments and other products.

Looking at total U.S. domestic exports to China for the period March-July 2020, U.S. exports were $38.963 billion ($7.792 billion/month) compared to $45.054 billion in 2017 ($9.011 billion/month). These include both products covered by the Annex 6.1 commitments and other products.

Total 2017 U.S. domestic exports of goods to China were $120.1 billion. The Phase 1 Agreement calls for increases on a subset of goods of $63.9 billion in the first year. Thus, the target for the first year of the U.S.-China Phase 1 Agreement is U.S. exports to China of $184 billion if non-subject goods are exported at 2017 levels.

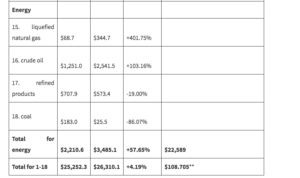

Other U.S. domestic exports not covered by the 18 categories in Annex 6.1 were $49 billion in 2017 (full year). For the period March – July, 2020 figures for the 18 categories have increased 4.19% from comparable levels in 2017. Non-covered products (which face significant tariffs in China based on retaliation for US 301 duties) have declined 36.10%, and total exports to China are down 13.52%.

Thus, the first five months of the 1st year of the U.S.-China Phase 1 Agreement suggest that U.S. domestic exports of the Annex 6 goods will be $71.496 billion if the full year shows the same level of increase over 2017 for each of the 18 categories of goods; non-covered products would be $31.306 billion, for total U.S. domestic exports to China of $102.802 billion. This figure would be far below 2017, below 2018 and just 9.25% above 2019. It is obviously dramatically below the target of $184.0 billion.

Even accepting the steep decline in non-covered goods, the first year should result in total U.S. domestic exports of $166.321 billion if the increase in covered goods is achieved — an amount 61.79% greater than current trends for total U.S. exports. To achieve that level of U.S. exports in the August 2020-February 2021 period, U.S. domestic exports of the 18 categories of goods in Annex 6.1 would have to be $108.705 billion ($15.529 billion/month) an amount nearly three times the monthly rate of exports of the 18 categories to China in the March – July 2020 period ($5.262 billion/month).

Chinese data on total imports from all countries (in U.S. dollars) for January-July show a decline of 5.7% from the first seven months of 2019. http://english.customs.gov.cn/statics/report/monthly.html. General Administrator of Customs of the People’s Republic of China, China’s Total Export & Import Values, July 2020 (in USD). China’s imports from the U.S. were down 3.5% during the same time period. Total U.S. domestic exports to China are down slightly more for the first seven months vs. 2019, 4.151%. China data for August are also available. Total imports into China for the first eight months of 2020 are down 5.2%, those from the United States down 2.9%.

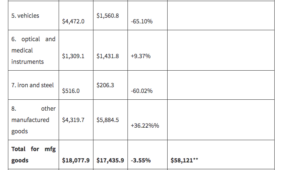

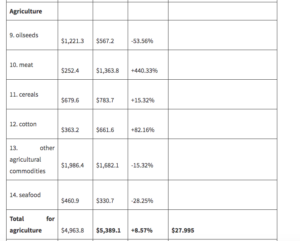

The 18 product categories included in Annex 6.1 of the Phase 1 Agreement show the following for March-July 2017, March-Julye 2020 and rate of growth for the first year of the Agreement versus full year 2017 (figures in $ million):

- HS 8802 for aircraft shows no U.S. domestic exports to China for any month in the 2017-July 2020 period based on U.S. Census data as compiled by the U.S. International Trade Commission’s data web. U.S. export data don’t show orders just shipments.

- The Phase 1 increase for manufactured goods and for all goods is overstated to the extent that the dollar value of increased purchases include aircraft, since U.S. domestic export data are not showing any shipments to China.

China has recovered more quickly from COVID-19 economic challenges than has the U.S. However, as reviewed above, their total imports from all countries (and from the United States) are down in the first eight months of 2020. Thus, whether China will or can expand imports from the U.S. to the extent envisioned by the U.S.-China Phase 1 Agreement in the first year of its implementation is yet to be seen, but seems highly unlikely despite the position taken by the U.S.

Conclusion

The U.S.-China Phase 1 Agreement is a potentially important agreement which attempts to address a range of U.S. concerns with the bilateral relationship and obtain somewhat better reciprocity with the world’s largest exporter. The Phase 1 Agreement has left other challenges to a Phase 2 negotiation which has not yet begun and will not begin before 2021 at the earliest.

While there has been some progress on non-trade volume issues that are included in the Phase 1 Agreement, there has been very little forward movement in expanding U.S. exports to China. Indeed with the sharp contraction of U.S. exports of products not included in Annex 6.1 of the Phase 1 Agreement, the current trend lines will have U.S. total exports of goods to China coming in lower than was true in either 2017 or 2018 and only somewhat higher than the depressed 2019 figures. More importantly, the trend line of U.S. domestic exports would result in China missing its first year target for purchases of U.S. goods by $63.5 – 81.2 billion. By back loading purchases of various U.S. agricultural products, China can project greater efforts to meet purchase targets and yet not actually take the goods ahead of the forthcoming Presidential elections.

With the process of selecting a new Director-General for the World Trade Organization entering the final phase where Members will be winnowing down the list of eight candidates to one which hopefully will receive consensus support by early November, it is unclear when and if the WTO will be able to engage in meaningful reform efforts such that the large bilateral concerns between the U.S. and China can be brought back under the WTO or whether the world is in for many years of bilateral tensions with actions outside of the system the norm and not the exception.

Terence Stewart, former Managing Partner, Law Offices of Stewart and Stewart, and author of the blog, Current Thoughts on Trade.

To read the original blog post, click here