In the last 25 years global value chains have come to dominate global trade in a way surprisingly little discussed or understood. To meet the policy challenges of today and the future we need to understand the key characteristics of this new global trade and how they came about.

The OECD estimate around 70% of total trade takes place in global value chains. Using their definition as where “the different stages of the production process are located across different countries”, and considering both goods and services inputs, this may be an understatement.

The example most commonly used is the automotive sector, with 30,000 parts and associated services like satellite navigation going into one car. However there are many others. Modern primary commodity production is optimised by technology developed in other countries, diverse services and goods are frequently combined to create new product offerings, and most international business to consumer transactions are facilitated by leading global platforms.

Positively this new globalization has provided consumers with an unprecedented choice of products at affordable prices. More challengingly it has seen governments struggle with the question of how they can best influence modern trade, amid signs of a backlash and simple demands for ‘more domestic manufacturing’.

The popular global narrative that feeds such demands is one that has a traditional view of trade as a set of simple primary or manufactured goods transactions. Policymakers must move on from this narrative, making their choices, and explaining them clearly, on the basis of global value chains.

Why Global Trade Changed

The dramatic fall in the cost of transporting goods since the 1970s due to containerisation is well documented. More recently the Internet in particular has reduced the cost of transporting ideas and other services since 1990. Together these developments mean large companies can source their final products by taking their pick of the best ideas and most economic facilities from around the world. This process of breaking down final production in turn accounts for most of the 900% rise of goods trade since the mid-1980s.

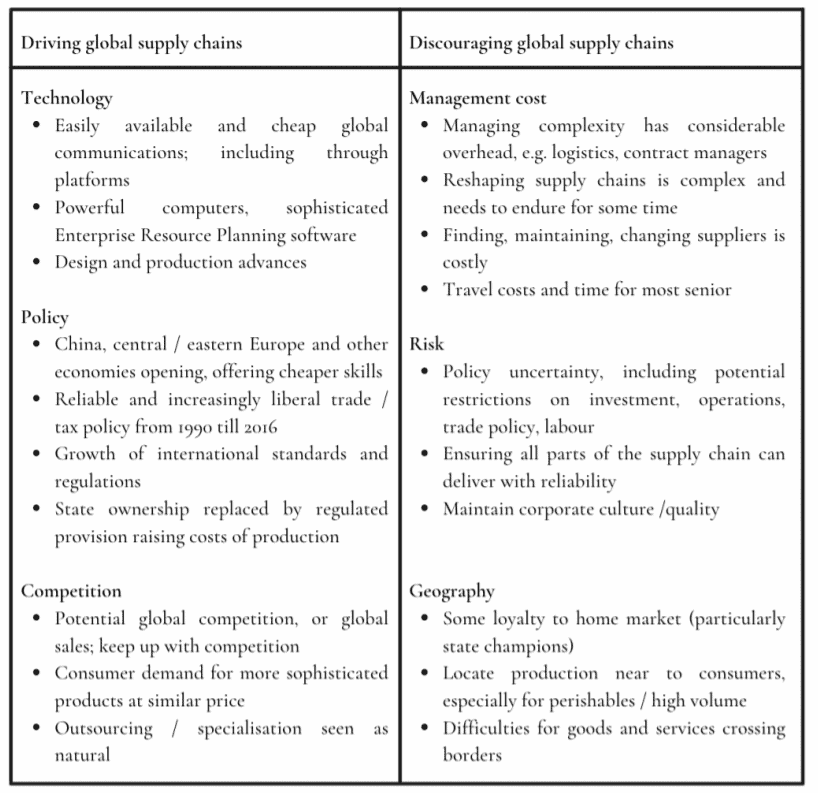

Yet companies also face constraints in their choices. Complexity in operation is likely to increase risk. This is why governments seeking to attract companies have sought to offer reassurances, not always successfully, against domestic policy change. The drivers around global supply chains are thus complex, and likely to remain so.

Picturing Global Supply Chains

Global value chains use individual goods or services inputs which are in various ways processed into a finished product to a customer. The diversity of how this happens is almost endless, with no single model, and thus no single predictable response to change.

In the previously mentioned automotive case, a set of physical components are made into a car, combined with services such as car’s information systems, and sold as a single product with the possible addition of warranty or financing. Supermarkets combine products bought, and those made specifically, with services such as loyalty schemes. Both use sophisticated computer systems developed by third parties to manage stock levels and human resources. They will draw upon marketing experts, quality systems and third party contact centre providers where required.

Overall the sum of all these transactions form a complex network running across borders to constitute the majority of global trade. There is trade outside these networks, for example direct international manufacturer-to-consumer retail or transfers of precious metals, but far less than that happening within global chains. Understanding this is of vital importance in understanding a national economy.

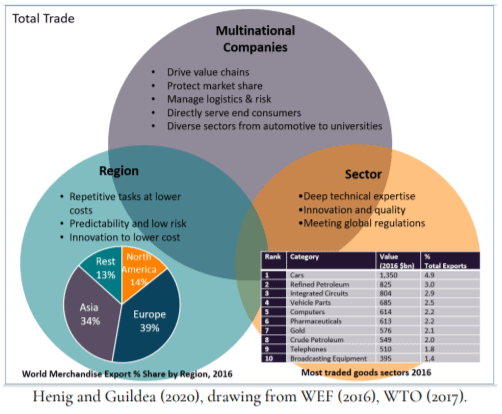

Identifying three distinct elements to the supply chains can help conceptualise this network. The large enterprises which drive the process balance their supply chains between sectoral expertise, increasingly global, and lower cost repeat production, looking first within their region if sufficiently economical.

This can be illustrated as below, noting that while modern trade is particularly concentrated in three regions, Asia (mainly East, South, and Southeast), Europe, and North America, there is a diversity of traded goods and services sectors.

Implications of Global Value Chains

Globally competitive companies must make their own decisions about how best to operate their supply chains. Governments cannot in general force them to increase domestic production, or indeed make any quick decisions. Global value chains and modern trade therefore exist largely outside the direct control of politicians, even where national champions or state owned enterprises exist. This lack of control over the economy may even influence governments to revert to more traditional views of trade in the hope this can make a difference.

Yet governments can and do influence value chain decisions. China positioned itself in the 1990s as a low cost high quality provider of complex consumer products on behalf of multinationals through various policies. European countries have sought to create specialist clusters of deep technical expertise, in the car industry, aerospace, or pharmaceuticals. Conversely new barriers to UK-EU trade are seeing some supply chains restructured without UK components.

Governments have numerous policy levers, such as trade, skills or taxation policy, but need to think carefully about the nature of modern trade in using them. President Trump’s targeting of US imports from China in the hope of stimulating domestic production failed to consider value chains. Rather it encouraged some manufacturers to transfer production to Vietnam to avoid tariffs, where such a short term move was possible, rather than set up expensive new operations in the US.

Similarly Free Trade Agreements focused predominantly on old models of trade are no guarantee of attracting greater domestic manufacturing or greater participation in supply chains. While stable and open trade relations are an important foundation, individual changes are unlikely to be significant. Similarly predictable regulatory and skills frameworks are likely to be more important than constant change. Supporting specialisms, reducing general costs for example through better infrastructure, and attracting major inward investments would then seem to be specific policies which could enhance supply chain participation.

Conclusion

Global value chains have become the predominant reality of international trade, and the factors behind their growth seem unlikely to change significantly. The ability for companies to operate globally, using the best technology and most cost efficient production, is here to stay. The implications are profound, economically and politically, as we may have already seen in the rise of populism, but equally in providing equipment and global research collaboration to fight Covid. Policy makers need to adjust their assumptions on trade accordingly, before considering what actions will be most effective in meeting their objectives.

To view the original research by the European Centre for International Political Economy, please click here.

NG-series-Paper-2